Did you know if you have income from investments, you may be subject to the Net Investment Income Tax?

You may owe this tax if you receive investment income and your income for the year is more than certain limits. Here are some key tips you should know about this tax:

- Net Investment Income Tax. The law requires a tax of 3.8 percent on the lesser of either your net investment income or the amount by which your modified adjusted gross income exceeds a threshold amount based on your filing status.

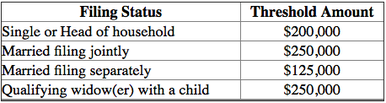

- Income threshold amounts. You may owe this tax if your modified adjusted gross income is more than the following amount for your filing status:

· Net investment income. This amount generally includes income such as:

o Interest,

o Dividends,

o Capital gains,

o Rental and royalty income, and

o Non-qualified annuities.

This list is not all-inclusive. Net investment income normally does not include wages and most self-employment income. It does not include unemployment compensation, Social Security benefits or alimony. It also does not include any gain from the sale of your main home that you exclude from your income.

If you need more information, please contact us at [email protected] or 714-841-9710.

o Interest,

o Dividends,

o Capital gains,

o Rental and royalty income, and

o Non-qualified annuities.

This list is not all-inclusive. Net investment income normally does not include wages and most self-employment income. It does not include unemployment compensation, Social Security benefits or alimony. It also does not include any gain from the sale of your main home that you exclude from your income.

If you need more information, please contact us at [email protected] or 714-841-9710.